- Look condition-provided software, such as those offered from Wisconsin Property and Financial Creativity Authority (WHEDA).

- Select if you meet the requirements predicated on income limitations or other criteria lay by the program.

- Talk to a homes therapist for suggestions for offered guidelines choice.

Examining Loan Solutions and you may Guidance Programs

When embarking on your way of buying an initial home during the Wisconsin, understanding the differences when considering financing products plus the great number of advice applications offered is extremely important to make the best solutions.

Old-fashioned financing are not insured by the any bodies company and you may generally speaking require a top advance payment. As well, government-supported fund, including FHA loans, Va money, and you may USDA financing, provide more versatile qualification requirements and generally want reduce money.

What are WHEDA Loan Applications?

The latest Wisconsin Casing and Economic Innovation Power (WHEDA) brings novel mortgage choice like the WHEDA Advantage FHA and WHEDA Effortless Close to help first-time homeowners into the Wisconsin. Such programs was geared towards reducing initial can cost you you need to include selection loans in Lazear to own advance payment assistance.

What Unique Funds Are for sale to Veterans and Army Solution Users?

The fresh new You.S. Institution out-of Pros Facts offers Va finance being targeted at military experts, services users, as well as their partners. They give you significant professionals, eg no downpayment, no private financial insurance rates, and you can competitive rates.

What Guidelines Software Are offered for Down Repayments or other Financial Aids?

Other than loan apps, there are many different recommendations choice including forgivable downpayment advice grants during the metropolitan areas eg Milwaukee and you will statewide products such as the WHEDA Investment Availability. While doing so, the loan Borrowing from the bank Certification System (MCC) offers a tax credit so you’re able to first-time homeowners according to the attract paid down to their mortgage.

The house Purchasing Process and functions

Navigating your house to get process inside Wisconsin involves insights several key procedures, from working with real estate agents towards latest closing measures. To own first-time homeowners, gripping this type of degrees assurances an easier changeover with the homeownership.

Just who Is to First-Go out Homebuyers Work on?

First-date homeowners must look into integrating that have a knowledgeable realtor who’s better-qualified when you look at the navigating the brand new Wisconsin property field. An agent will assist finding homes you to meet up with the buyer’s conditions and get within this purchase price limitations to own first houses.

What are the Give, Evaluation, and you will Appraisal Procedures?

Shortly after a home is selected, the customer can make an offer and that, if recognized, proceeds toward examination and you can appraisal tips. The house assessment is essential as it shows one problems with the house, since assessment guarantees the brand new house’s value suits or exceeds the newest mortgage number.

How does the Closure Processes Really works and you may Exactly what Costs are In it?

The latest closing procedure marks the final step in the home get, where transfer of the home is completed. People are prepared for closing costs, which are typically dos-5% of amount borrowed. It is important to ask for closure prices advice applications, like those supplied by the newest Wisconsin Agencies regarding Construction and you will Metropolitan Advancement (HUD)together with Federal Construction Administration (FHA), which will surely help reduce financial burdens in the event you be considered.

Financial Information and you can Homeownership Can cost you

Whenever getting into the journey so you’re able to homeownership inside Wisconsin, potential customers need to comprehend the newest intricacies out of financial pricing and you can additional expenses associated with to find a property. This includes being conscious of the different mortgage selection, insurance costs, assets taxation, or any other a lot of time-identity expenditures.

What is the Greatest Mortgage Rate for you?

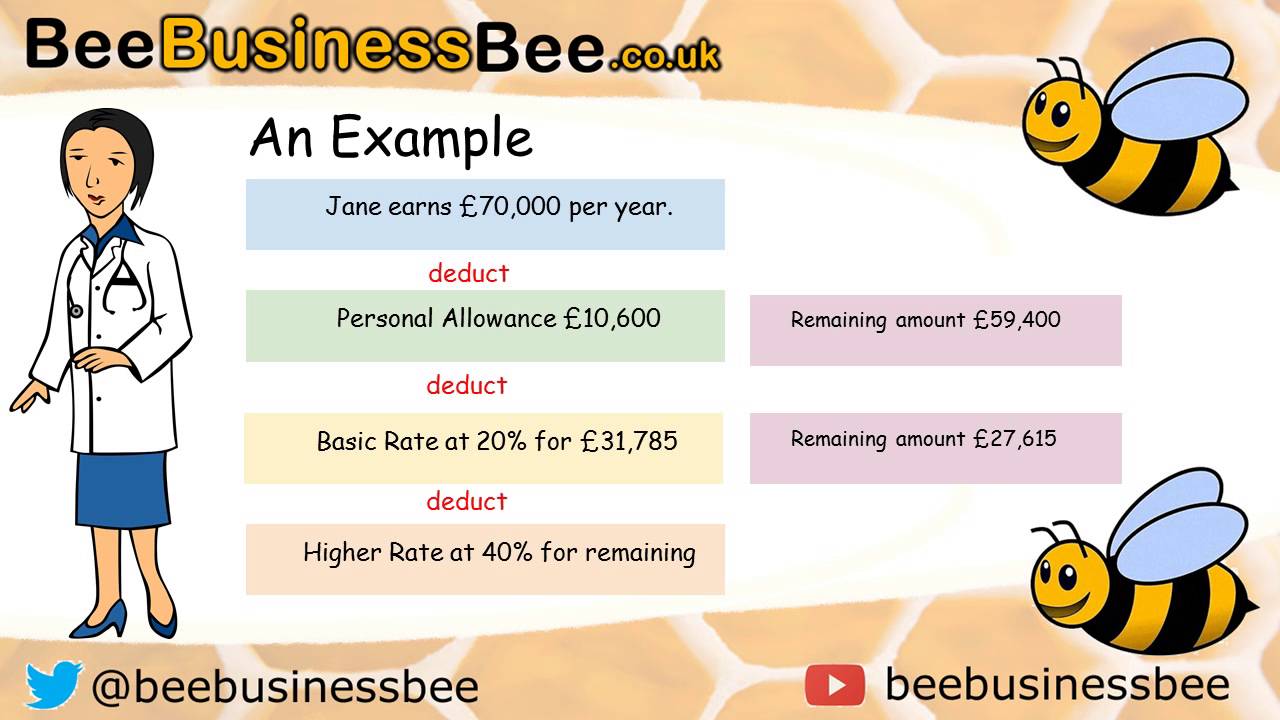

Financial rates was important to the fresh cost out of a property. For the Wisconsin, average home prices normally drive more financial solutions. Fixed-rate mortgages offer balance having a reliable interest rate over the lifetime of the mortgage, that is best for those considered a lot of time-identity homeownership. Potential real estate buyers may consider finding lower interest rates so you’re able to remove its payment, nevertheless they will be measure the loan’s apr (APR) knowing the true price of credit.