The Backstage Publication. A house Investor, Coach, #step 1 Greatest-Offering Copywriter, and you may Tony Honor Winner.

I have been committing to home for more than 15 years, but in the beginning, like any anyone, We quickly first started trying pay-off my home loan, figuring this new faster I’d reduce the debt, the greater. Up coming, At long last knew something which features transformed the way i thought from the my resource means. It epiphany have place me personally into the a program so you’re able to monetary versatility that is so much more energetic and you can successful than becoming free out-of personal debt.

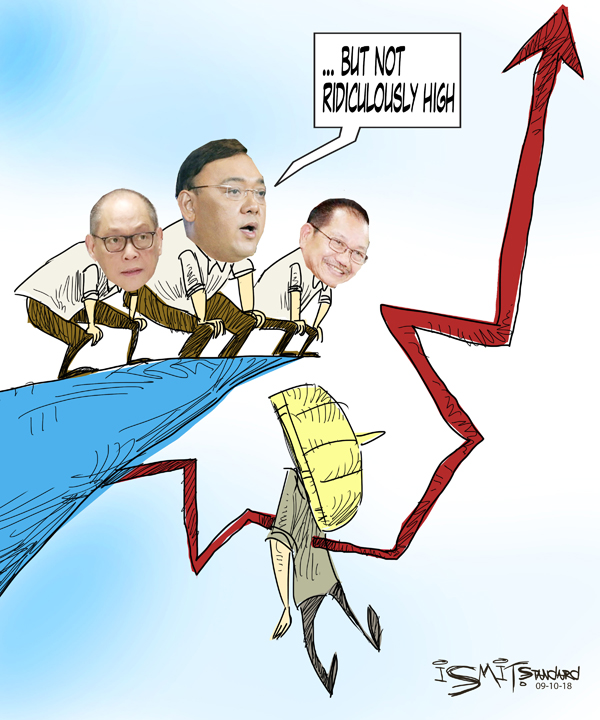

And offered you can keep you to loans, the greater the potential for the you can easily yields. In reality, let’s say I told you that just insurance firms an affordable, well-prepared mortgage to possess 30 years in the place of 15 years, you could potentially secure three-quarters from a million cash?

Debt Is not An excellent Monolith

Whenever a lot of people contemplate obligations, it immediately imagine personal debt try crappy remove it Asap! In most cases, I agree that the idea of are loans-free produces done experience in the beginning. Exactly what I have read is that all the costs are not equivalent.

Thankless debt such as credit cards, pricey auto loans, and private money all are samples of what of a lot telephone call crappy loans. As to the reasons? They often hold high rates and other costs. A loans advantages you, now or perhaps in the near future, and assists your introduce a credit history – eg student education loans otherwise a fair financial into a home. Above all, it frees right up money to see meet your needs proper today.

Paying and having gone bad obligations is very important. No one has to be hiking the fresh financial steps with this kind away from baggage in pull. But if you need certainly to extremely create your money, settling your financial wouldn’t enable you to go once the far or as fast as prudently leveraged possessions usually. Check out items to inquire:

A mortgage Causes Equity

You want a spot to real time, therefore to purchase a home is going to be a smart capital. Their month-to-month mortgage repayments slowly repay the debt, called building guarantee. That’s much better than providing they in order to a landlord and you will enabling create its guarantee in lieu of yours.

Home financing Will help Create Passive Earnings

Accommodations assets can produce passive income – payouts that you don’t actually want to benefit – monthly. Also, their tenant’s rent pays down the financial obligation and there would be taxation professionals, as well.

Regardless – number one quarters or rental assets – often people favor a shorter home loan name, will fifteen years in the place of 31, however, paying the financial obligation regarding rapidly may not help you create wealth shorter. Although it could make you then become best that you repay the personal debt easily, youre missing out on certain important lives and you may wealth-strengthening solutions.

Day Is on Their Front

Inflation reduces your dollar’s to invest in control of day. Having a home loan, youre credit playing with the current cash however, expenses the loan right back which have future cash. The worth of those cash will get quicker each year, however won’t need to shell out so much more.

Credit money today and you can purchasing you to definitely same count right back later on, in the event that dollar’s worthy of try faster, are a smart means. This can possess a very high impact more 3 decades instead of fifteen years. Put day (and you can rising prices) on your side and loosen up your mortgage payments having just like the long as possible.

The fresh new Wonders Of Self-confident Carry

The most significant disagreement quietly of them who want to pay off their loans quickly was attract. Attract is the quantity of your mortgage payment you to goes toward the bank since their funds to have giving you the borrowed funds. New offered the definition of, the more appeal you will shell out over the longevity of the latest financing.

The entire cost of an excellent $five hundred,000 mortgage at the a good 5% interest rate getting three decades is actually $966,279 having monthly installments off $dos,684.

Into the face from it, nobody wants to expend almost $255,000 in additional desire across the lifetime of the borrowed funds. But really, if you’re that attention improvement is actually generous, you’ll find astounding experts that can come with-it. Their 29-12 months mortgage has far shorter repayments, providing you with an additional $1,270 on the pocket per month which will change your top quality out of lives. In addition to this, for individuals who actually want to build your money, you could lay those funds with the an alternate financial support. Provided one most other capital has actually a higher go back than simply the loan, might make a profit. This notion is named positive bring.

The thought of confident bring is that you was providing advantage of your own difference between the price of the borrowed funds as well as the come back you can buy of the purchasing the money someplace else. Particularly, a difference between your appeal youre spending into the that loan (5%) as opposed to brand new cash you obtain using the individuals dollars someplace else (8%) perform result in an optimistic carry (3%).

Utilizing self-confident bring, might actually end up being earning profits off the bank’s money. The amount can be extremely reasonable over the 30-12 months lifetime of the mortgage. A great $step one,270 capital per month, getting simply 3%, combined monthly, more thirty years, expands so you’re able to $745,089. Sure, your realize you to definitely truthfully. Inside scenario, which have a mortgage for thirty years rather than 15 years grows their wealth by the nearly about three-house out of a million dollars. An important here is to spend your money on a chance able to produce you to definitely 3% carry.

Winning Which have Influence

Is clear, I am not saying proclaiming that someone would be to live beyond its form. No one should pile on obligations – however an awful idea. Influence try a massive multiplier – they magnifies both victories and you will losses versus prejudice. But don’t be afraid in order to maintain obligations in order to raise forget the prospective.

It’s not necessary to become obligations-free to have the monetary versatility which comes out of extra cash in your pocket per month, otherwise growing your own wide range because of positive bring. Have fun with power to increase your production, simply do very responsibly. It change inside therapy of shunning the financial obligation https://paydayloancolorado.net/stratton/ on the a good even more nuanced means really can speed their efficiency.