Should it be updating a kitchen area, covering medical expenditures, combining debt, otherwise refinancing your own mortgage, solutions in life when you need accessibility cash. One way possible to obtain the money you want is by using a property guarantee mortgage and therefore hinges on this new collateral you’ve got found in your home.

What is actually equity? A good question! Equity is the difference between your debts on your own mortgage and you will exacltly what the house is already well worth. Every month which you pay your financial you will get a small way more guarantee that’s applied for when it comes to a home security financing. There’s a lot to know about these types of financing however it is well worth your time and effort understand advantages once the well as what to expect if you decide to apply.

How does a home Equity Financing Works?

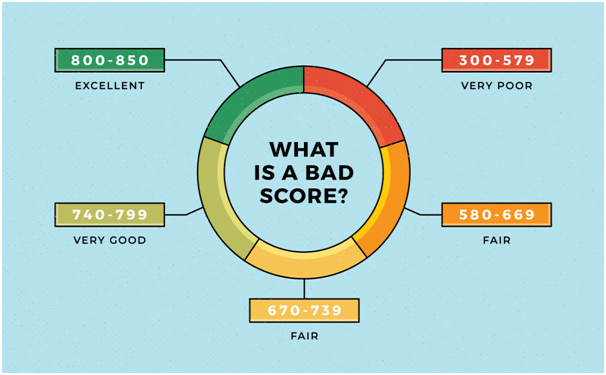

House equity fund is a form of covered loan that utilizes new collateral of your house once the security. Residents pay the loan that have monthly premiums more than a predetermined label. The quantity you could borrow is normally doing ninety% Loan-To-Worthy of, which means around ninety% of the home’s total worth. Your revenue and credit rating along with factor into the maximum amount a loan provider are willing to financing.

How much Could you Borrow?

The absolute most you could potentially use having a house security financing depends on the latest equity together with Loan-To-Worthy of ratio (LTV). Stick to the example below to decide exactly how much you can borrow.

To determine a great residence’s equity, basic, you need to know its market value. Following, you should deduct the bill in your financial on the ple, you have $175,000 leftover on your own financial, and also the appraised well worth is $500,000. Brand new home’s equity was $500,000 minus $175,000 or $325,000.

To qualify for a home collateral mortgage, you’ll want at the very least ten% guarantee of your home. To determine the equity commission, estimate the brand new LTV.

Basic, divide the borrowed funds equilibrium of the appraised really worth. Then, proliferate the result because of the 100. Deducting the quantity off 100 offers the part of equity of your property. Eg, isolating the borrowed funds equilibrium away from $175,000 because of the appraised worth of $500,000 causes 0.thirty-five. Multiplying 0.35 by 100 equals an LTV from thirty-five%. Deducting the fresh LTV away from 100% brings a share regarding equity from 65%.

Maximum amount borrowed cannot go beyond ninety% of one’s residence’s appraised well worth. Regarding analogy, 90% away from $five hundred,000 are $450,000. Regarding the $450,000, subtract the bill due in your mortgage, that is $175,000. The essential difference between the fresh new appraised really worth, that is $275,000, is the maximum loan amount.

How can you Play with property Equity Loan?

By using the collateral of your property to fund expenses was an excellent reasonable-rate cure for make the the best thing sensible. Household collateral funds are used for limitless choices. Really consumers make use of the funds to possess home improvements, debt consolidation reduction, college tuition, scientific costs, or even re-finance the mortgage.

Is House Security Personal lines of credit like House Equity Finance?

A house security personal line of credit or HELOC differs from a good home guarantee mortgage because it operates as a rotating line of credit for example handmade cards where you only create payments toward count you may have lent. Including, you may have an effective HELOC out of $100,000, you may spend $20,000 to put on an alternative rooftop, your monthly payments would be according to the $20,000, perhaps not the newest $100,000.It is reasonably various other as they come with a variable notice price in line with the Federal Reserve’s finest price, versus a fixed rate, and are usually organized in two pieces, brand new mark period (if you can withdraw money) therefore the installment period. Money need to nevertheless be made in the fresh new mark months, but usually they simply mirror the interest owed.