Hence, you can apply this predetermined overhead rate of 66.47 to the pricing of the new product X. The following equation is used to calculate the predetermined overhead rate. The production hasn’t taken place and is completely based on forecasts or previous accounting records, and the actual overheads incurred could turn out to be way self-employment tax 2020 different than the estimate. The predetermined overhead rate calculation shown in the example above is known as the single predetermined overhead rate or plant-wide overhead rate. Since we need to calculate the predetermined rate, direct costs are ignored. This example helps to illustrate the predetermined overhead rate calculation.

Do you own a business?

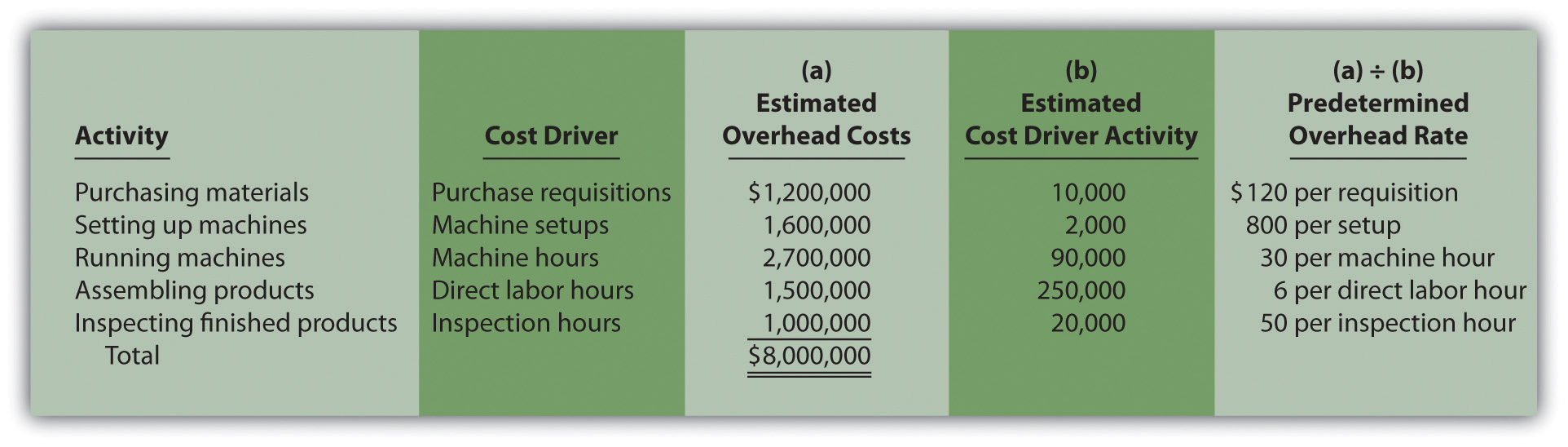

In these situations, a direct cost (labor) has been replaced by an overhead cost (e.g., depreciation on equipment). The predetermined overhead rate formula is calculated by dividing the total estimated overhead costs for the period by the estimated activity base. Common examples include machine hours, direct labor hours, or direct materials costs.

Divide budgeted overheads with the level of activity

Two companies, ABC company, and XYZ company are competing to get a massive order that will make them much recognized in the market. This project is going to be lucrative for both companies but after going over the terms and conditions of the bidding, it is stated that the bid would be based on the overhead rate. This means that since the project would involve more overheads, the company with the lower overhead rate shall be awarded the auction winner.

Calculating Overhead Rates: Formulas and Examples

For instance, it has been the traditional practice to absorb overheads based on a single base. For instance, a business with a labor incentive environment absorbs the overhead cost with the labor hours. On the other hand, the business with the machine incentive environment absorbs overhead based on the machine hours.

- This calculator offers a straightforward way to estimate the predetermined overhead rate, making it easier for businesses to manage and allocate their manufacturing overhead costs effectively.

- This record maintenance and cost monitoring is expected to increase the administrative cost.

- Two companies, ABC company, and XYZ company are competing to get a massive order that will make them much recognized in the market.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

For this, you can take the average manufacturing overhead cost for the previous three months, and divide this by the machine hours in the current month. If you then find out later that in fact the actual amount that should have been assigned is $36,000 dollars, then the $4000 dollar difference should be charged to the cost of goods sold. The concept is much easier to understand with an example of predetermined overhead rate. For instance, imagine that your company has a new job coming up, and you need to calculate predetermined overhead rate for an estimate of manufacturing costs.

Get in Touch With a Financial Advisor

The predetermined overhead rate was found by dividing the estimated manufacturing overhead cost by the estimated total units in the allocation base, so the predetermined overhead cost per unit is $9.00. The predetermined overhead rate is calculated by dividing the estimated manufacturing overhead by the estimated activity base (direct labor hours, direct labor dollars, or machine hours). For instance, if the activity base is machine hours, you calculate predetermined overhead rate by dividing the overhead costs by the estimated number of machine hours. This is calculated at the start of the accounting period and applied to production to facilitate determining a standard cost for a product. Overhead rates help businesses allocate indirect costs across departments.

If the business used the traditional costing/absorption costing system, the total overheads amounting to $26,000 will be absorbed using labor hours. It helps you understand how much you spend on operating your business beyond direct costs. Knowing this can help you set prices that cover all costs and make a profit. This guide will walk you through the steps to calculate your overhead rate. First, you need to figure out which overhead costs are involved, and then create a total of this amount.

Its production department comes up with the details of how much the overheads will be and what other costs will be incurred. Small companies typically use activity-based costing, while large organizations will have departments that compute their own rates. Different businesses have different ways of costing; some use the single rate, others use multiple rates, and the rest use activity-based costing. Departmental overhead rates are needed because different processes are involved in production that take place in different departments.

Company B wants a predetermined rate for a new product that it will be launching soon. The estimate is made at the beginning of an accounting period, before the commencement of any projects or specific jobs for which the rate is needed. Sourcetable, an AI-powered spreadsheet, streamlines complex calculations, empowering you to focus on results rather than processes. With features tailored for easy calculation and the ability to test these on AI-generated data, Sourcetable makes it easier and quicker to apply overhead rates in various scenarios. This will help you price your services correctly and increase your profits. If you want to simplify this process, consider using business software like MyOverhead.