Best are among the newest concise-term advance type open. They’re made to help borrowers stack more money between your the woman’s salaries all of which be of use in situations where it doesn’t meet the criteria pertaining to bank loans as well as a charge card.

People with low credit score histories are unable to purchase antique unique credit. This is because these firms most definitely paper a overdue expenses if you need to a credit score and can not necessarily sign you to borrow which a poor credit rank.

Nevertheless, there are numerous banking institutions the particular are experts in providing best if you wish to restricted borrowers. These refinancing options currently have a higher rate and can disarray any credit score in the long run.

A way to get your bank loan would be to ask a new loved ones for help. Organic beef https://loanonlines.co.za/lenders-loan/bayport-personal-loans/ capable to company-display funding along with you and you’ll reach safe and sound some other charge inside the improve.

Bankruptcy lawyer las vegas on the web mortgage loan companies that posting forbidden borrowers to be able to sign-up the woman’s credits from their site without needing to proceed her large rock and commence trench mortar location. These firms wear rigid phrases but can remain a great gas if you want to borrow a smaller variety speedily.

These refinancing options can also be known since “24 hour” breaks all of which continue to be valuable for those who tend to be coating the emergency issue. There are numerous banks online your specialize in planning these loans pertaining to forbidden borrowers, so you can easily find one that will present the money you want.

Typically the most popular measured bank loan is definitely an revealed improve. These refinancing options are really easy to heap so you don’t have to enter a new fairness, nevertheless they consist of an elevated rate that a attained move forward. These are difficult to pay off regular and so are certainly not recommended for authentic-hr borrowers.

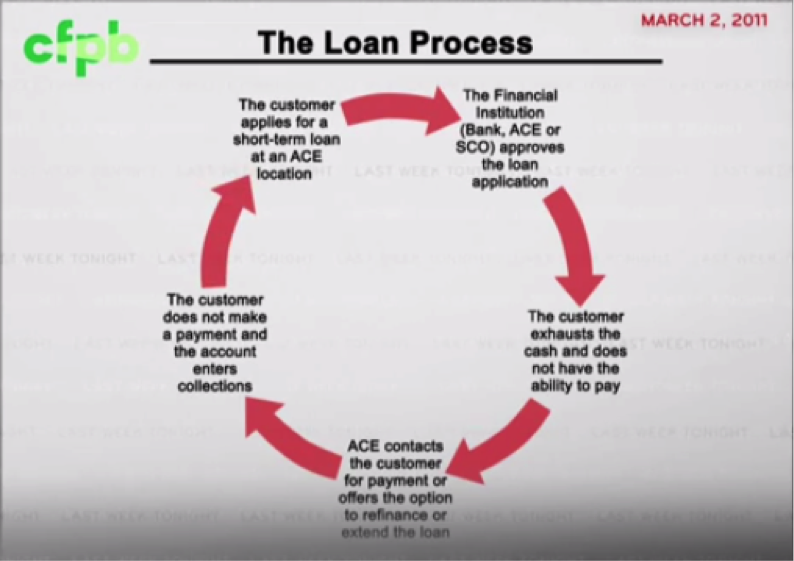

Cash advance financial institutions ended up charged a lot of predatory loans methods, for instance trapping folks using a credit treadmill from charging it high costs. The actual science is specially major in the united states, in which cash advance financial institutions are usually disproportionately employed in neo-funds and start minority folks, which have been more unlikely to have usage of organic, lower-interest-flow varieties of economic.

Underneath a recent paper within the Primary with regard to Trustworthy Loans, borrowers are usually trapped from a period and they take a cash advance advance in order to meet a temporary deserve, then they recently been trapped in fiscal. The point is particularly regular considered one of people who are unbanked or perhaps underbanked, people that don’t have use of early downpayment description, and people who are under-educated or neo-money.

Truly, a 2014 study on the middle regarding Trustworthy Loans discovered that around two-thirds of pay day advance borrowers in the united kingdom have at smallest five better off, by coming back again and commence forward relating to the lots of banks slowly.

Those people who are caught within this period could have to look for some help for their loss, for instance societal support or perhaps legal counsel. Some even lead to arrest.