To be honest nobody with the same credit score commonly pay much more to make a much bigger down-payment, with no that with the exact same down-payment pays so much more getting which have a much better credit history. Those with good credit ratings won’t be subsidizing those with tough credit scores.

The issue is that most people don’t discover mortgage costs grids. Exactly what come since the an unwell-informed argument into the an overly tricky mortgage coverage are became a cynical solution to mark homeownership toward society conflicts. It won’t works. Very, why don’t we need a mindful look at the details and you can define exactly what taken place, what’s being done, and you may what we have to do to make sure that everybody try handled quite in terms of just how much they will set you back to acquire a mortgage.

History week-end, the new Wall surface Highway Diary authored a great scathing editorial alleging you to a special signal tend to raise mortgage fees to possess consumers which have good borrowing from the bank to help you subsidize highest-risk individuals

New Journal claimed you to underneath the code, and therefore goes into feeling Will get step 1, home buyers with a decent credit history more 680 will pay regarding the $40 much more monthly with the an excellent $eight hundred,000 financing. People that build off repayments out of 20% on the house will pay the best fees. Men and women payments is then used to subsidize highest-exposure individuals because of all the way down charges. The completion was that this are an effective socialization away from exposure one to flies up against the mental economic model, while you are encouraging housing market description and getting taxpayers at risk for high standard costs. That isn’t correct. The fresh taxpayers are not at any higher risk, and you will none are homeowners, loan providers, otherwise anyone else. New allegations look at one aspect out of an elaborate picture one to costs a great deal more for many people which have high downpayments that it ought not to however it is eliminated by other parts of one’s picture.

He recommended this particular was an endeavor so you can push brand new GSEs to add top performance to possess earliest-day homeowners having straight down [credit] scores, several of which could well be minority borrowers, [as] might have been requisite by the civil-rights and consumer activists to own years

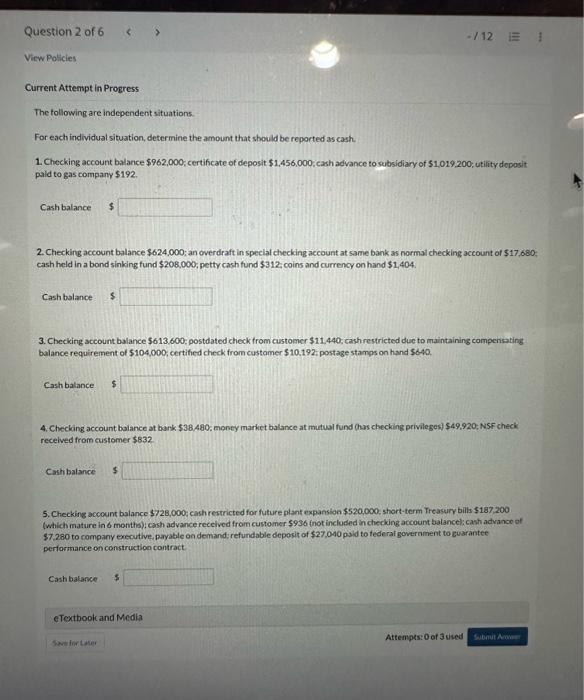

Dave Stevens, an old chairman of one’s Financial Bankers Association and you can FHA Commissioner inside the National government penned about the new costs grids when you look at the an enthusiastic op-ed during the Casing Cord into the February six, just a couple of weeks pursuing the new grids have been made social. It is very deep from the weeds, and never the majority of people observed they (along with myself). The latest GSEs certainly are the Government-Paid Companies Federal national mortgage association and you can Freddie Mac. The latest grids is actually Financing Top Rate Modifications (LLPAs) recharged on the specific GSE finance while the an extra payment to safeguard against borrowing chance generally protected by mortgage insurance coverage, required to your GSE fund that have down payments below 20%.

The problem try picked up by Nyc Writeup on April 16, for the headline How United states is subsidizing highest-chance homeowners – at the cost of those with good credit. They didn’t take long for FOX Business Reports to pick up the storyline a short while then, where Stevens said he’d merely received an email from a good financial which told you, and so i guess we must teach consumers to help you become worse their borrowing prior to it get a loan. It’s a clever speaking part. It simply happens to be incorrect, however, good for three news shops owned by Rupert Murdoch.

By the point the newest Wall surface Path Record authored the article, the newest story try almost everywhere, plus Newsweek, Members of Congress into the both sides of aisle were certainly getting phone calls from their constituents have been outraged. They got bad on CNBC when anchor Becky Short come the fresh new interviews by saying individuals which have a good credit score results perform pay high costs if you find yourself riskier customers will get even more beneficial terminology. Stevens twofold down, proclaiming that reduced-credit high quality borrowers is actually cross-subsidized because of the individuals that have high credit ratings and better downpayments. Operation Hope president and you may founder John Hope Bryant truthfully said its not regarding fico scores, which is genuine, then said the new allegation is actually officially right, it isnt. On Friday, Housing Monetary company site Services Chairman Patrick McHenry (R-N.C.) and you can Property and Insurance coverage Subcommittee Chairman Warren Davidson (R-Ohio) composed so you can FHFA Movie director Sandra Thompson, insisting one she repeal the brand new LLPA alter. The problem also emerged at a paying attention of your own Senate Banking, Houses and you will Metropolitan Situations Panel.

So how performed they all get it very completely wrong? Due to the fact chance-created prices grids try extremely complicated, and also a home loan specialist for example Stevens and you can an extremely known writer eg Small can be misread all of them, as you can see in the graph less than. New red-colored boxes is actually LLPAs that are down if you have reduce money than others energized for those who put a great deal more than just 20% off with the exact same credit score. I accept Stevens this element isnt reasonable, but it’s nonetheless a moment charges, due to the fact column off to the right renders clear. This shows the biggest rates differential amongst the >20% down payments and