Trick Takeaways

- You see the actual financing restrict on the condition or the county we want to buy a home here.

- You can get household examined by the a personal household inspector basic.

- Brand new proportion is important because your home mortgage is actually contingent on the it.

What is actually an enthusiastic FHA financing?

Back in 1934, pursuing the Great Despair, the government already been insuring mortgages included in FDR’s The fresh new Package and have come this since. FHA Fund is awarded from Federal Housing Commission. These loans is actually mortgage loans backed by the federal government to simply help People in america who don’t feel the instantaneous finance to put into the highest off payments required by extremely lenders in order to secure a mortgage financing. In order that the us government to take action, homebuyers have to fulfill some strict guidelines in order to meet the requirements. We shall walk you through the newest FHA loan recommendations below.

What’s home loan insurance policies & how come I want to pay they?

The main advantageous asset of an enthusiastic FHA mortgage is the capacity to purchase property with little money down, but in return government entities makes you pay a mortgage insurance coverage premium otherwise MIP per month. MIP do cover the us government bank if for example the consumer was basically ever so you’re able to default on their financing. Which advanced usually stays energetic into the life of the loan (in the event you put a down-payment less than 10%), but there are ways to beat it like refinancing your own home loan afterwards down the road.

What are the financing limitations to your a colorado FHA mortgage?

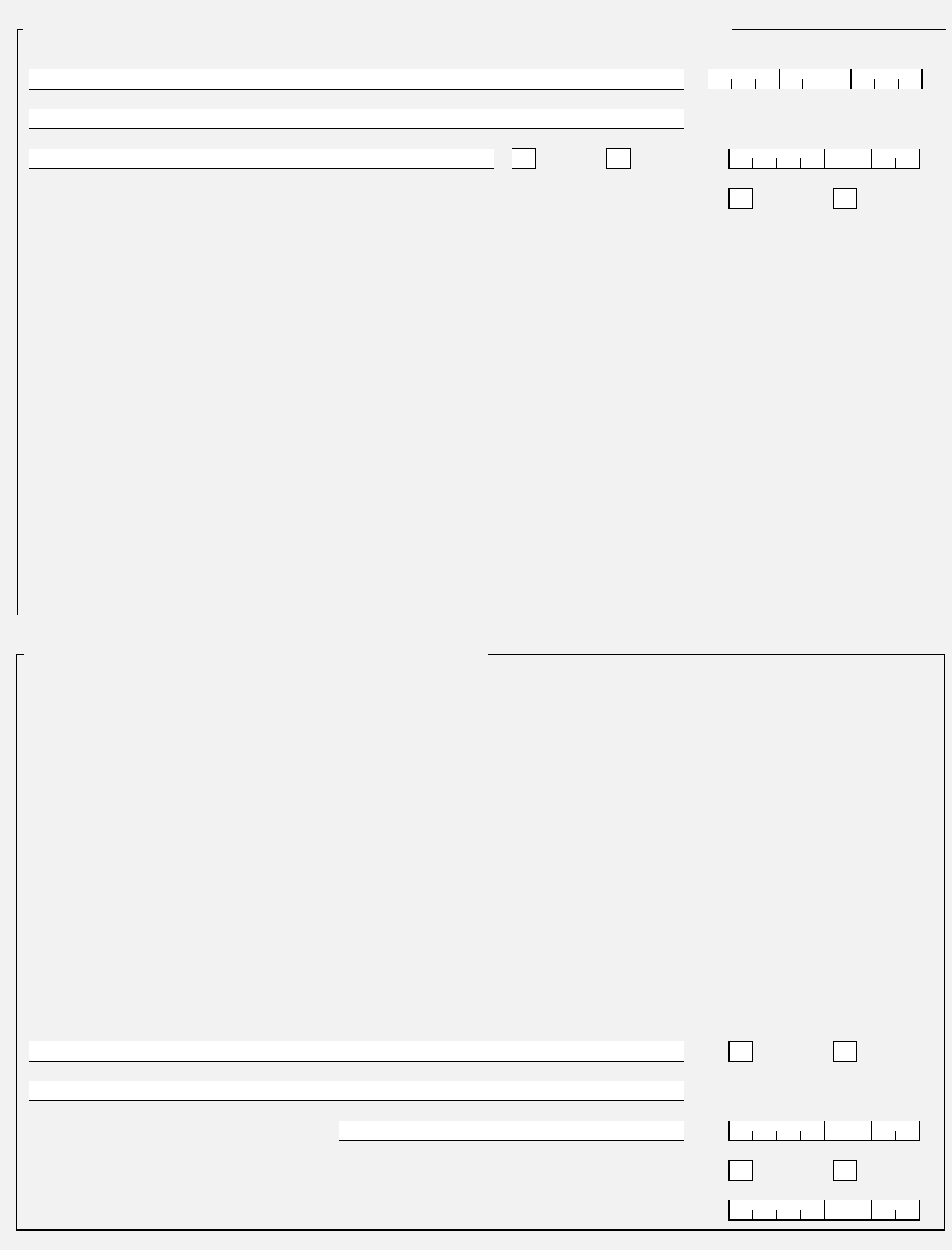

The usa Agencies of Homes and you will Metropolitan Development or better-known once the HUD kits the FHA loan restrictions typically at 115% off the median home rate for each for every single county for each and every county. Which maximum is meant to bring homebuyers sensible finance to possess homes that are modestly valued. FHA financing are not for these customers who happen to be looking for more expensive land. https://paydayloancolorado.net/deer-trail/ Because home values try ranged per county so are the mortgage limits. You find the actual financing limit in your county and/or county we need to purchase a home right here.

You should buy an excellent FHA acknowledged condominium with an enthusiastic FHA mortgage. FHA Condo Funds are supplied compliment of FHA Point 234(c). This new Area 234(c) system assures one creditworthy person that suits FHA financing direction with an authorities backed home mortgage getting 3 decades to find a tool within the good condo building. For those who are already clients as they are from inside the apartments one are going to be turned into condominiums, that it FHA insurance rates shall be a means of these tenants to help you don’t be displaced. not, you will find limitations on buildings that you may are interested an effective condominium in such, whilst have to contain at the least four equipment. Those individuals tools can consist of isolated or semi-detached units, row properties, walkups, or a lift framework. More and more these types of fund is available toward HUD website.

Preciselywhat are FHA back-stop and you can side-avoid ratios?

Back-avoid and you may top-stop rates relate to your DTI or loans-to-earnings proportion. Brand new ratio is essential because your home loan try contingent into they. Your back-end proportion depends upon the sum of the all your minimum financial obligation costs split because of the how much cash your month-to-month disgusting earnings is actually from your work, whereas merely the homes can cost you dictate leading-stop proportion. DTI for the FHA money are currently ; the initial number as the top-avoid maximum and you will second being the right back-end limitation. From time to time, these rates might be high, you genuinely wish to have that matter down. A minimal DTI number often means a lower life expectancy rate of interest.