Proprietors’ funds include share capital, reserves and surpluses as per the balance sheet. The price-to-earnings (P/E) ratio is a measure of how much investors are willing to pay for each dollar of a company’s earnings. The P/E ratio is calculated by dividing the market price of a share by the earnings per share. Some common balance sheet ratios include the debt-to-equity ratio, the current ratio, the acid-test ratio, and the inventory turnover ratio. The Proprietary Ratio, also known as the Equity Ratio, is a crucial financial indicator as it helps assess a company’s financial stability or health.

How does the proprietary ratio affect capital structure?

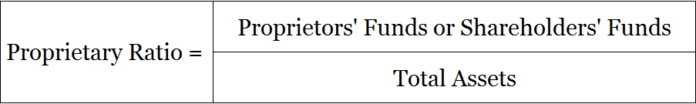

In a nutshell, the proprietary ratio is a type of solvency ratio allowing investors and financial analysts to determine how much equity shareholders are contributing to the business. As you can see from the formula, you must take the amount of equity provided by equity shareholders and divide that by the company’s total assets. Total assets refers to a company’s total assets on its balance sheet regardless of how it was funded (through debt or equity). The main objective of using this ratio is to see how much of a company’s total assets are funded by the proprietors (or shareholders).

- On the other hand, a low proprietary ratio indicates higher reliance on debt financing, which increases the company’s financial risk and potential for instability.

- Let’s look at an example of a proprietary ratio to better understand the concept.

- The proprietary ratio measures the contribution of shareholders or proprietors toward the company’s total assets, providing a clear indication of financial stability.

- Proprietary ratio shows the total assets of a company which are financed by proprietors’ funds.

- Ask a question about your financial situation providing as much detail as possible.

Part 2: Your Current Nest Egg

On the other hand, a lower ratio may indicate higher dependency on debt, increasing the risk for lenders. Proprietary Ratio, also known as the Equity Ratio or Net Worth Ratio, is a financial ratio used in accounting and finance to assess a company’s financial leverage. It indicates the proportion of a company’s total net worth (equity) relative to its total assets. The ratio is important as it helps investors, creditors, and analysts evaluate a company’s capital structure, financial stability, and risk profile.

How Does GooglePay Earn Money? (GooglePay Business Model Revealed)

It should be used in conjunction with the net profit ratio and an examination of the statement of cash flows to gain a better overview of the financial circumstances of a business. These additional measures reveal the ability of a business to earn a profit and generate cash flows, respectively. The proprietary ratio components are shareholders’ or proprietary funds and total assets, including goodwill, etc. The proprietary ratio is also known as the ‘equity ratio’ which indicates the portion of total assets being held by a company that is funded by the proprietors’ funds.

What kind of Experience do you want to share?

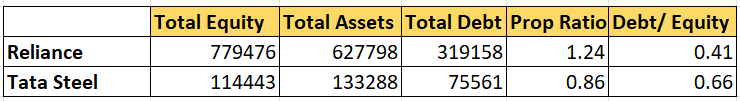

One common mistake in calculating the proprietary ratio is excluding certain components from total assets, such as off-balance sheet items. Another error is miscalculating shareholders’ equity by leaving out reserves or surpluses. Finally, interpreting the ratio in isolation can lead to misleading conclusions, as it needs to be considered alongside other financial ratios. A ratio value below 0.5 or 50% indicates that the business relies more on leveraged funds. This could indicate that the company is in significant debt, and its profitability may be affected.

Balance Sheet Ratios Explanation With Examples FAQs

It helps to test the capacity of the firm regarding its long-term solvency and financial stability of a company. Conversely, a low ratio indicates that a business may be making use of too much debt or trade payables, rather than equity, to support operations (which may place the company at risk horizontal analysis formula calculator of bankruptcy). In the latter case, a business may need to acquire a significant equity investment in order to remedy the perceived risk level caused by the existence of too much debt on its balance sheet. Hence, the first method would increase our debt in the company and make us look risky.

When a company’s proprietary ratio is high, it means that it has enough equity to be able to support its ongoing business operations. The proprietary ratio allows you to estimate the company’s capitalization used to fund the business. It is also known as equity ratio or net worth ratio or shareholder equity ratio. Calculate current assets and current liabilities when the current ratio is 2.5 and working capital is $180,000. In this example, Company A has a higher proprietary ratio, indicating a lower reliance on debt and a more financially stable position. Estimating the proprietary ratio gives valuation information when it is assisted by the debt-to-equity ratio.

It is used as a screening device for financial analysis, a higher ratio, say more than 75% means sufficient comfort for creditors since it points towards lesser dependence on external sources. On the other hand, a lower proprietary ratio indicates that the long-term loans and other obligations are less secured and they can lose their money. Proprietors’ funds include equity share capital, preference share capital, reserves, and surplus. Total assets refer to all company-owned assets, including fixed assets, current assets, investments, and other assets. By dividing shareholders’ equity by total assets, the proprietary ratio reveals the percentage of a company’s overall assets that are availed by employing internal capital. This metric is useful for investors, creditors, and analysts interested in evaluating a company’s financial health and risk profile.