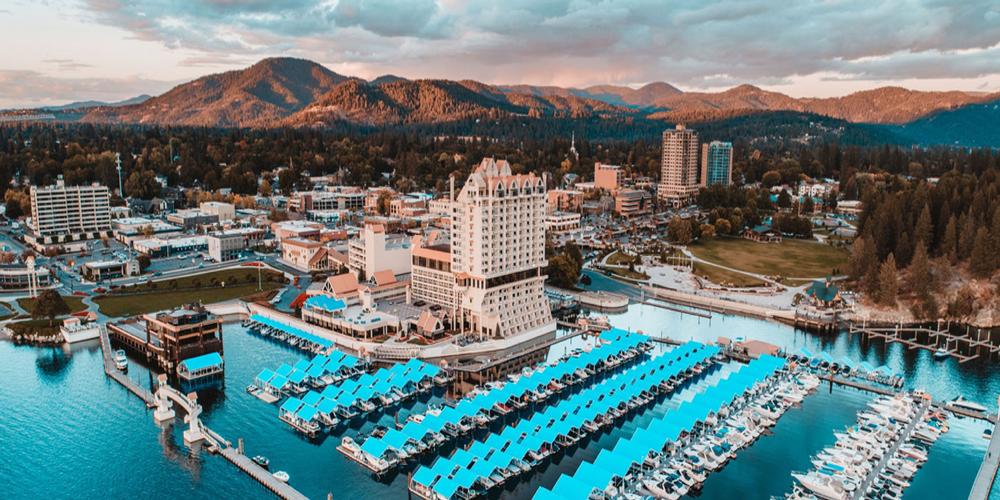

Settlement costs are definitely the amount you will need towards the top of your down-payment to acquire a house. MoMo Projects/Getty Photo

- Knowledge closing costs

- Overview of average settlement costs

- Circumstances impacting settlement costs

- Ideas on how to guess the closing costs

Associate hyperlinks for the products on this page are from people that make up all of us (select all of our marketer disclosure with the list of people for much more details). Yet not, all of our viewpoints try our very own. See how i speed mortgages to write objective evaluations.

- Financial settlement costs usually start from 2% so you can 6% of your own loan amount.

- They can vary extensively by the lender and you will area Brilliant loans.

- There are some an approach to lower your closing costs making the loan more affordable.

Settlement costs are one of the several biggest initial expenses you can easily have to cover when buying a home. And even though the actual number possible pay can differ quite a good part, you can basically expect to pay somewhere between dos% and six% of your own overall amount borrowed.

Who would add up to as much as $6,600 to $20,000 to your an average-listed household (according to Redfin study about next one-fourth out of 2024). That is in addition to an excellent 20% down payment off $82,460

Insights closing costs

Closing costs is actually a primary expense to consider while looking for a home loan or offered to purchase property. Your own closing costs could add notably into count you prefer to order a home, consequently they are an amount which is separate from the deposit.

What are settlement costs?

Closing costs consist of this new charges your happen inside processes of going a home loan. They can incorporate the financial lender’s origination charges, the fresh new appraisal you have towards home, or the price of getting a name browse. Settlement costs are very titled since you’ll spend this type of costs on the closure of one’s loan.

Exactly why are settlement costs needed?

Settlement costs compensate various businesses in your house pick or refinance – your own financial, real estate professional, appraiser, surveyor, and. Nevertheless they buy things like your HOA fees, possessions taxes, home insurance, or any other necessary costs out of homeownership.

You are able to rating a loan instead of closing costs, but will, the expenses roll into the life of the borrowed funds. You could find you to financing with all the way down if any closure costs provides increased home loan rate of interest, which will make will cost you more than only paying front. A lender might incorporate settlement costs towards loan’s principal, hence increases the overall matter possible shell out desire on the.

Closing costs try paid back for some of the organizations that help you complete the homebuying processes and close in your house. Listed here is an ending costs breakdown, with respect to the Federal Set aside.

Mortgage origination charges

The bulk of the settlement costs is certainly going on their lender. They is frequently an enthusiastic origination commission out-of 0% to a single.5% of your own loan amount you to definitely goes to brand new lender’s will cost you from underwriting and making preparations your own home loan, as well as other bank-side costs, such as for example a software fee ($75 so you can $300), credit file payment, (as much as $30), plus.

Assessment and you may review costs

Your bank have a tendency to buy an appraisal so that the home is value at least the degree of the loan. That it generally can cost you ranging from $300 to $700, depending on where you stand discovered. You’ll be able to has most examination costs (eg pest monitors, such as).

Term insurance coverage and you will payment charges

Lenders possess a title organization focus on a search on the residence’s term so you can find out if the vendor ‘s the property owner hence the fresh new title does not have any any liens on it. Lenders usually need consumers to buy good lender’s term insurance policy as well, and this protects the lending company when the name things been right up afterwards. If you’d like this safety yourself, additionally, you will need certainly to buy a customer’s label insurance coverage. Expect to pay to $700 to help you $900 for the name attributes.